Winners and Losers in Customer Experience 2020: Mid-Year Check-In Edition

If you’re in the business of making and selling something, improving the customer experience is an essential focus, now more than ever, with the world’s essential pivot toward online experiences. While every enterprise will have their own key focus areas, needs and approaches, the 2020 Update from 451 Research highlights some elements of CX trends that will drive success or lead to failure.

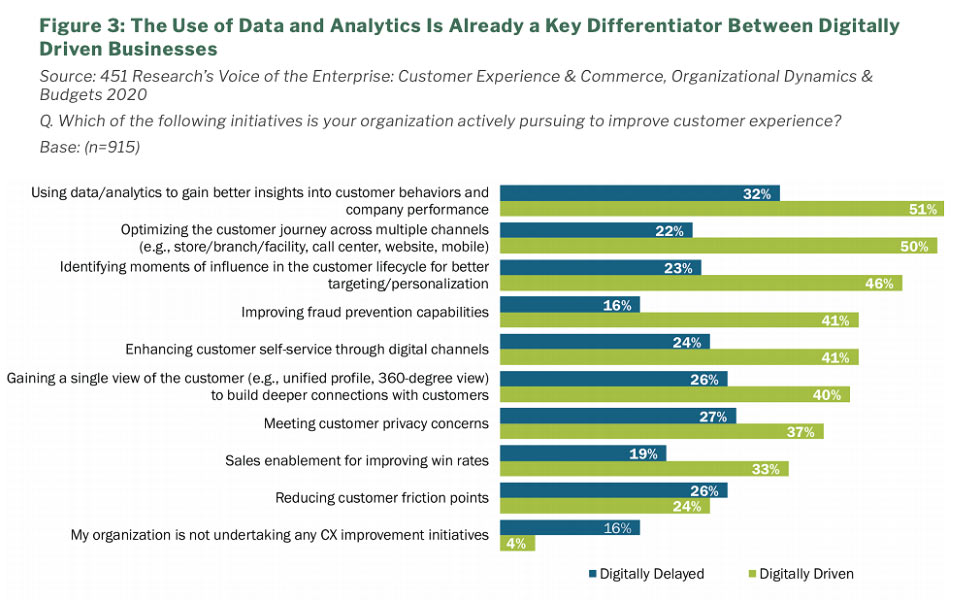

The Use of Data and Analytics Is the Key Differentiator Between Digital Leaders and Laggards

In the recently released 451 Research’s Voice of the Enterprise: Customer Experience & Commerce; they asked about key initiatives organizations are actively pursuing to improve customer experience and then rated the “digital drivers” – aka the winners – vs the “digitally delayed”.

Below is their chart showing the stark differences around areas – the top 3 show where winners are focusing; getting insights about customer behavior and the corresponding ROI inside the company, omni-channel optimization for the audience of one customer; and identifying the key moments of influence.

Having real-time data is the difference between pleasing the customer in the moment; with mutually beneficial outcomes; vs a less responsive, less satisfying outcome.

Don’t think of “payments” as a cost of doing business.

While it’s noted above the importance of understanding the whole of the customer’s journey across channels and from beginning to end, one area must be understood and optimized; and that is at the moment of payment.

As we noted earlier this year; there has been a rapid increase in “bankless” transactions; and with consumer spending down, against the backdrop of 80% of shoppers having shifted at least some of their in-store spending online as a result of the pandemic, businesses simply cannot afford to miss out on digital sales due to poor payment experiences.

Since “Customer Experience” contains the word customer; this highlights the fact that the point of payment is a place to make or break said experience. PYMNTS recently analyzed the key friction points experienced by consumers browsing, shopping and paying for purchases on international eCommerce sites. They reviewed the checkout processes of 266 B2B and B2C eCommerce sites across 12 industries and operating from locations across Europe and the United States to provide a comprehensive overview of the checkout experience.

Speed matters. Top-performing eCommerce merchants— those with the 20 highest index scores — have checkout processes that take an average of just 98.6 seconds to complete.

This is almost half

the time it took to complete checkouts with bottom-performing merchants — those with the 20 lowest scores — which averaged 195.9 seconds. That is a range you cannot stay at the slow end of and expect to keep your customer.

Language and Currency choice matters. The average top-performing merchant also accepts 8.8 payment methods in 54 currencies, which compares to an average of 5.9 payment methods in 15 currencies for middle performers. Bottom performers tend to have the most limited selections, accepting just 3.3 payment methods and 1.3 currencies on average.

IP Address and Mobile Optimization Matters to B2B as much as B2C.

While business-to-business and business-to-consumer eCommerce markets are radically different in their sizes and dynamics, the top performers utilize similar approaches to reducing friction. They have a similar usage – just under 50% – of using IP recognition technology to streamline and secure their checkout processes; and both have nearly universal mobile-optimizing of their sites, at 95.1 percent and 88.6 percent, respectively.

New Business Models; Social Distancing = Subscription and Direct to Consumer

Even before the pandemic moved many consumers staples shopping online; Amazon had been aggressively promoting / discounting subscription purchases of many supplies. 451’s report confirms this finding that 46% of merchants strongly agree that creating alternative consumption models, such as subscriptions and rentals is a priority for their business. They also see that 65% of merchants with both B2C and B2B sales are shifting toward direct-to-consumer sales to increase revenue.

In Summary: Invest in Effectiveness, Ease and Emotion

CX in the Age of Covid is being discussed broadly; and these 3 E’s are the ideal state that a business should aspire to provide; according to Forrester’s recent survey. They have been interviewing consumers about their experiences with their favorite brands and in 2020, while no brand has attained Excellence (another E!) nearly 20% were rated as Very Good on the 3 vectors mentioned above.

We don’t think it’s a coincidence that the various studies are calling out how data is a driver of an excellent customer experience which drives both enhanced loyalty and increasing lifetime value. Having worked with leaders in the AdTech, eComm and Financial Services industry, we know that providing real-time data and the richest user profile are a key to success… now more than ever.